Delving into historical inscriptions provides a unique window into the economic intricacies of ancient civilizations. The inscriptions of the Nidugal Cholas, in particular, offer valuable insights into their financial management—the fascinating details surrounding revenue and tax levies as documented in the inscriptions of the Nidugal Cholas.

Uncover the various sources of revenue mentioned in the inscriptions. Whether through agricultural produce, trade, or other means, trace the origins of income that fueled the Nidugal Chola economy.

The capital towns of Nidugal and Hemavathi (Henjeru) appear to have functioned as crucial trade centers. The primary items of sale comprised spices, leather goods, and textiles

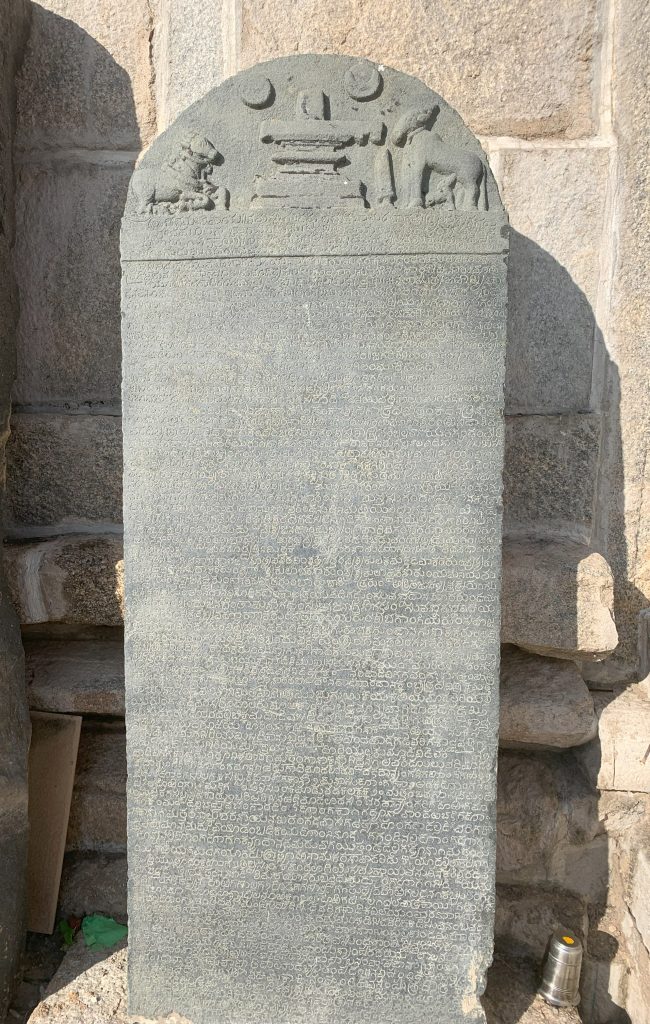

- Date1248CE

- Inscription place: Nakareshwara(Nagareshwara)Temple,Nidugal

- Source:Epigraphia Carnatica Vol 12

During the reign of Irungola-Dêva Cholamaharaj was ruling from Nidugal. There are also customs dues on many articles (specified with rates)and dues for marriages and other ceremonies(specified). And Nana-desi Maleyalas will pay for a hill horse 1 Hâga, and so on various articles(Specified)

a) Tax on food grains and edible commodity

- Avare(Hyacinth beans), Black Gram,Wheat, Pepper,areca nut, betel leaf, fenugreek seeds,Ajwain, mustard,cumin, Sabbasige(Dil seeds), Coriander, turmeric

- Ghee, Sugar, Salt

- Sugarcane, Coconut, Banana, and other fruits

b) Tax on Manure-pit (Thippe sunka)

c) Tax on Ceremonies (Marriage, naming ceremony)

Specified rates for the Bride and groom and also specified rates for the boy and girl for the naming ceremony.

d) Tax on foreign(remote) trader’s horses

- Specified1 Hâga each

“Interestingly, the inscriptions conspicuously omit any reference to millets and ragi, sparking speculation that these grains might have been exempt from taxation. Alternatively, their absence in the records raises the possibility that these crops were not cultivated in the region at that time.”

This prompts a call for deeper research into the agricultural landscape and potential regional influences that may have contributed to the exclusion of these grains from tax records

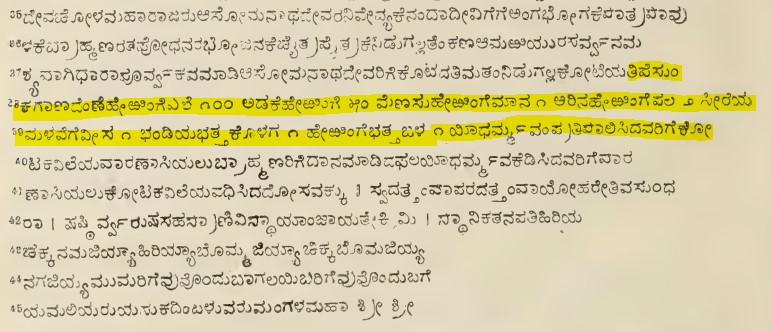

- Date1150CE

- Inscription place: Someshwara Temple, Nidugal

- Source:Epigraphia Carnatica Vol 12

In this inscription, Nidugal Chola details the various taxes, repeating the emphasis on the same commodity

During reign of Chalukya king Jagadekamalla and his Mahamandaleshwara (Nidugal Chola’s) Jagadekamalla Mallideva chola was ruling from Henjeru (Present Hemavathi)

“The great minister, Senadhipathi Hiriya Tantrapala Namana, for the offerings, illuminations and festivals of the God Nagareshwara of Nidugal, for the food of brahmanas and ascetics, constructed the virgin tank Nagasamudra,to the east of Mutukur,and washing the feet of Chandrbharana-pandita,granted it, with all ceremonies. He also granted in the Nidugal fort, the manure-pit tax, oil mill tax, and dues on betel leaf, arecanut, pepper, Saffron, women’s clothes, cart load of paddy.

Shiva

Thanks to vividly explain the social economic practices of olden days.

Good marratkon